The IRS recently published a tax tip explaining Form 1099-K, covering why taxpayers receive it, how to address incorrect forms, and recent updates to reporting rules. This update comes almost three weeks after reports emerged that some taxpayers received incorrect...

The IRS recently published a tax tip explaining Form 1099-K, covering why taxpayers receive it, how to address incorrect forms, and recent updates to reporting rules. This update comes almost three weeks after reports emerged that some taxpayers received incorrect...

Identity theft usually takes center stage during most tax-scam discussions. After all, so much of our personal and professional lives take place online in emails, texts, and direct messages—all of which are ripe targets for phishing attacks. However, not all identity...

Identity theft usually takes center stage during most tax-scam discussions. After all, so much of our personal and professional lives take place online in emails, texts, and direct messages—all of which are ripe targets for phishing attacks. However, not all identity...

New technology could improve tax return processing time at the IRS Paper returns have historically been slower to process due to the Internal Revenue Service having to manually transcribe information, leading taxpayers who want to more quickly receive their refund to...

New technology could improve tax return processing time at the IRS Paper returns have historically been slower to process due to the Internal Revenue Service having to manually transcribe information, leading taxpayers who want to more quickly receive their refund to...

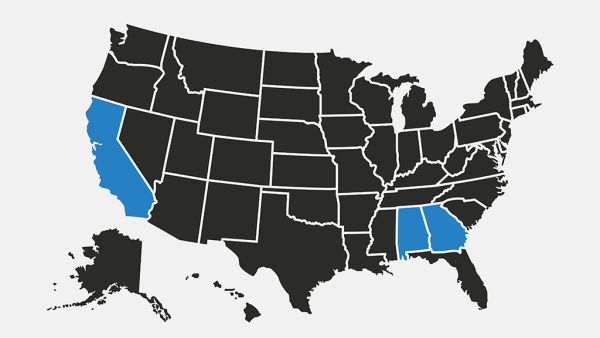

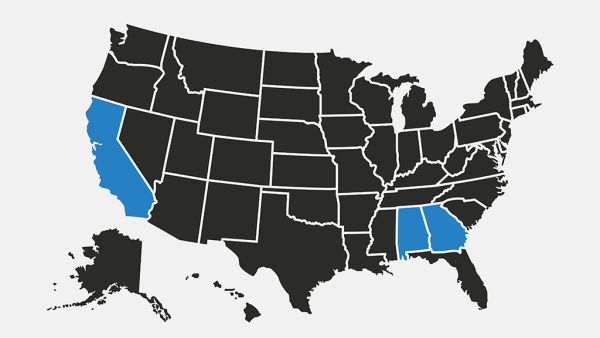

The Internal Revenue Service recently extended tax relief for disaster victims in Alabama, California, and Georgia. Individuals and businesses in these federally declared disaster areas now have until October 16, 2023, to meet several filing and payment deadlines. ...

The Internal Revenue Service recently extended tax relief for disaster victims in Alabama, California, and Georgia. Individuals and businesses in these federally declared disaster areas now have until October 16, 2023, to meet several filing and payment deadlines. ...

Taxpayers with foreign bank accounts who forgot to file an annual Report of Foreign Bank and Financial Accounts (FBAR) received some good news at the end of February. In Bittner v. United States, the Supreme Court held that the penalty for nonwillful failure to file...

Taxpayers with foreign bank accounts who forgot to file an annual Report of Foreign Bank and Financial Accounts (FBAR) received some good news at the end of February. In Bittner v. United States, the Supreme Court held that the penalty for nonwillful failure to file...